Pan-African e-commerce company Jumia listed on the New York Stock Exchange today, with shares beginning trading at $14.50 under ticker symbol JMIA. This comes four weeks after CEO Sacha Poignonnec confirmed the IPO to TechCrunch and Jumia filed SEC documents.

With the public offering, Jumia becomes the first startup from Africa to list on a major global exchange.

In an updated SEC filing, Jumia indicated it is offering 13,500,000 ADR shares, for an opening price spread of $13 to $16 per share, representing 17.6 percent of all company shares. The IPO could raise up to $216 million for the internet venture.

Since the original announcement (and reflected in the latest SEC docs), Mastercard Europe pre-purchased $50 million in Jumia ordinary shares.

The IPO creates another milestone for Jumia. The company became the first African startup unicorn in 2016, achieving a $1 billion valuation after a funding round that included Goldman Sachs, AXA and MTN.

There’s a lot to breakdown on Jumia’s going public. The company is often dubbed the “Amazon of Africa,” and like Amazon, Jumia comes with its own mixed buzz. Jumia’s SEC F-1 prospectus offers us more insight into the venture, and perhaps any startup from Africa, thus far.

About Jumia

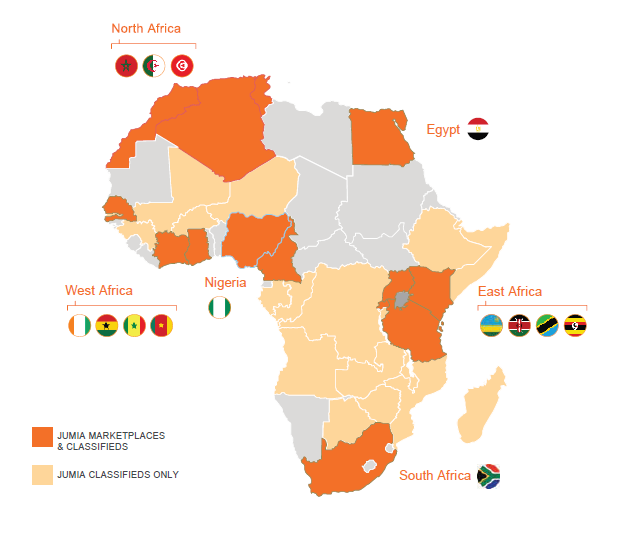

Founded in Lagos in 2012 with Rocket Internet backing, Jumia now operates multiple online verticals in 14 African countries. Goods and services lines include Jumia Food (an online takeout service), Jumia Flights (for travel bookings) and Jumia Deals (for classifieds). Jumia processed more than 13 million packages in 2018, according to company data.

Jumia’s original co-founders included Nigerian tech entrepreneurs Tunde Kehinde and Raphael, but both departed in 2015 to form other startups in fintech and logistics.

Jumia’s original co-founders included Nigerian tech entrepreneurs Tunde Kehinde and Raphael, but both departed in 2015 to form other startups in fintech and logistics.

Starting in Nigeria, the company created many of the components for its digital sales operations. This includes its JumiaPay payment platform and a delivery service of trucks and motorbikes that have become ubiquitous with the Lagos landscape. Jumia has extended this infrastructure as an e-commerce fulfillment product called Jumia Services.

Jumia has also opened itself up to Africa’s traders by allowing local merchants to harness Jumia to sell online. The company has over 80,000 active sellers on the platform using the company’s payment, delivery, and data-analytics services, Jumia Nigeria CEO Juliet Anammah told TechCrunch a previously.

The most popular goods on Jumia’s shopping site include smartphones, washing machines, fashion items, women’s hair care products, and 32-inch TVs, according to Anammah.

Jumia an African startup?

Like Amazon, Jumia brings its own mix of supporters and critics. On the critical side, there are questions of whether it’s actually an African startup. The parent for Jumia Group is incorporated in Germany and current CEOs Jeremy Hodara and Sacha Poignonnec are French.

On the flipside, original Jumia co-founders (Kehinde and Afeodor) are African. The company is headquartered (and also incorporated) in Africa (Lagos), operates exclusively in Africa, pays taxes on the continent, employs 5,128 people in Africa (page 125 of K-1), and the CEO of its largest country operation (Nigeria) Juliet Anammah is Nigerian.

The Africa authenticity debate often shifts into questions of a Jumia diversity deficit, which is of course important from Silicon Valley to Nairobi. The company’s senior management and board is a mix of Africans and expats. Golden State Warriors basketball player and tech investor Andre Iguodala joined Jumia’s board this spring with a priority on “diversity and making sure the African culture is in the company,” he told TechCrunch.

Can Jumia turn a profit?

The Jumia authenticity and diversity debates will no doubt roll on. But the biggest question—the driver behind the VC, the IPO, the founders, and the people buying Jumia’s shares—is whether the startup can generate profits and ROI.

Obviously some of the world’s top venture investors, such as Jumia backers Goldman, AXA, and Mastercard, think so. But for Jumia skeptics, there are the big losses. The company has generated years and years of losses, including negative EBITDA of €172 million in 2018 compared to revenues of €139 that same year.

To be fair to Jumia, most startups (e-commerce startups in particular) rack up losses for years before getting into the black. And operating in a greenfield sector in Africa—where it had to create much of the surrounding infrastructure to do B2C online sales—has presented higher costs for Jumia than e-commerce startups elsewhere.

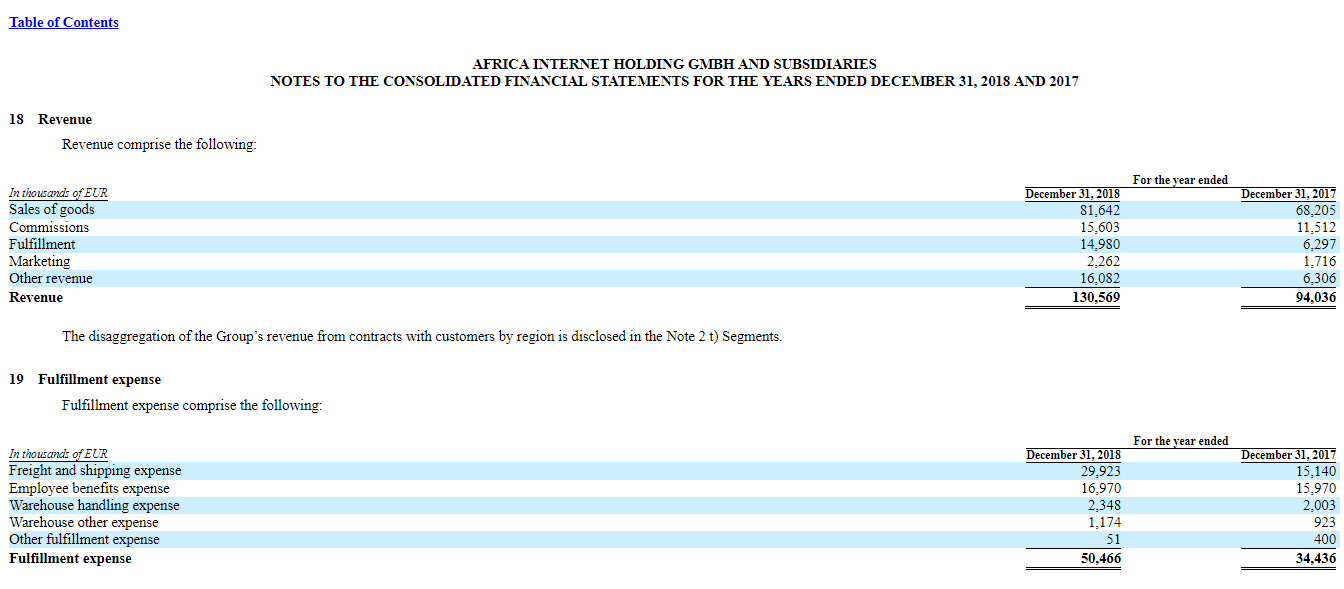

On the prospects for Jumia’s profitability, two things to watch will be Jumia’s fulfillment expenses and a shift to more revenue from its non-goods-delivery services, which offer lower unit costs and higher-margins. Per Jumia’s SEC F-1 index (see above) freight and shipping make up over half of its fulfillment expenses.

On the prospects for Jumia’s profitability, two things to watch will be Jumia’s fulfillment expenses and a shift to more revenue from its non-goods-delivery services, which offer lower unit costs and higher-margins. Per Jumia’s SEC F-1 index (see above) freight and shipping make up over half of its fulfillment expenses.

So Jumia has not turned a profit but its revenues have increased steadily, up 11 percent to €93.8M (roughly $106.2 million) in 2017 and up again to €130M (or $147 million) in 2018. If the company boosts customer acquisition and lowers fulfillment costs—which could come from more internet services revenue and platform investment with IPO capital—it could close the gap between revenues and losses. This reflects the equation for most e-commerce startups. With the IPO Jumia will have to publish its first full public financials in 2019, which will provide a better picture of profitability prospects.

Jumia’s IPO and African e-commerce?

There’s is, of course, a bigger play in Jumia’s IPO. One connected to global e-commerce and the future of online retail in Africa.

Jumia going public comes as Africa’s e-commerce landscape has seen its share of ups and downs, notably several failures in DealDey shutting down and the distressed acquisition of Nigerian e-commerce hopeful Konga.com.

As for the big global names, Alibaba has talked about Africa expansion, but for the moment has not entered in full.

As for the big global names, Alibaba has talked about Africa expansion, but for the moment has not entered in full.

Amazon offers limited e-commerce sales on the continent, but more notably, has started offering AWS services in Africa.

And this week, DHL came on the scene launching its Africa eShop platform with 200 global retailers on board, in partnership with MallforAfrica’s Link Commerce fulfillment service.

Competition to capture Africa’s digitizing consumer markets—expected to spend $2 billion online by 2025, according to McKinsey—could get fierce, with more global entries, acquisitions, and competition on fulfillment services all part of the mix.

And finally, the outcome of Jumia’s IPO carries weight even for its competitors. “Many things, like business decisions and VC investments across Africa’s e-commerce sector are on on hold,” an African e-commerce exec told TechCrunch on background.

“Everyone’s waiting to see what happens with Jumia’s IPO and how they perform,” the exec said.

So the share-price connected to NYSE ticker sign JMIA could reflect not just investor confidence in Jumia, but investor confidence in African e-commerce overall.

from Amazon – TechCrunch https://techcrunch.com/2019/04/12/african-e-commerce-startup-jumias-shares-open-at-14-50-in-nyse-ipo/

No comments:

Post a Comment